When it comes to saving money on health insurance in 2026, many people are taking a hard look at Bronze Tier Plans.

These are the lowest-cost options on the Health Insurance Marketplace, but cheaper doesn’t always mean better. Before you make a decision, you need to understand what you’re really getting. A Bronze plan can help reduce your monthly costs, but you’ll face higher out-of-pocket bills when you need care.

These are the lowest-cost options on the Health Insurance Marketplace, but cheaper doesn’t always mean better. Before you make a decision, you need to understand what you’re really getting. A Bronze plan can help reduce your monthly costs, but you’ll face higher out-of-pocket bills when you need care.

According to the Kaiser Family Foundation, Bronze plans made up approximately 30% of ACA enrollments in 2024, and that number is growing as the enhanced subsidies expire in 2026. That’s why more people from Broward County to the Space Coast are asking us if Bronze plans are really worth it.

Absolut Best Insurance has been helping Floridians get the right coverage for over 20 years. Our licensed agents in Deerfield Beach, Vero Beach, Tamarac, Micco (Sebastian), and Greenacres help you compare plans, prices, and benefits so you don’t waste money or get stuck with the wrong policy.

Why So Many Are Switching to Bronze Tier Plans in 2026

Since the federal expansion of ACA subsidies ended in 2025, more people are gravitating toward Bronze plans because of the lower monthly premiums. For healthy individuals who rarely visit the doctor, these plans can seem like a smart way to cut costs. But that decision isn’t always so simple.

| “We’ve seen a major uptick in interest for Bronze Tier Plans across our Florida offices. Many are trying to stay insured without overspending, especially in areas like Port St. Lucie and Greenacres, where the cost of living is already tight.” – Stacy Murphy, Owner/Operator of Absolute Best Insurance< |

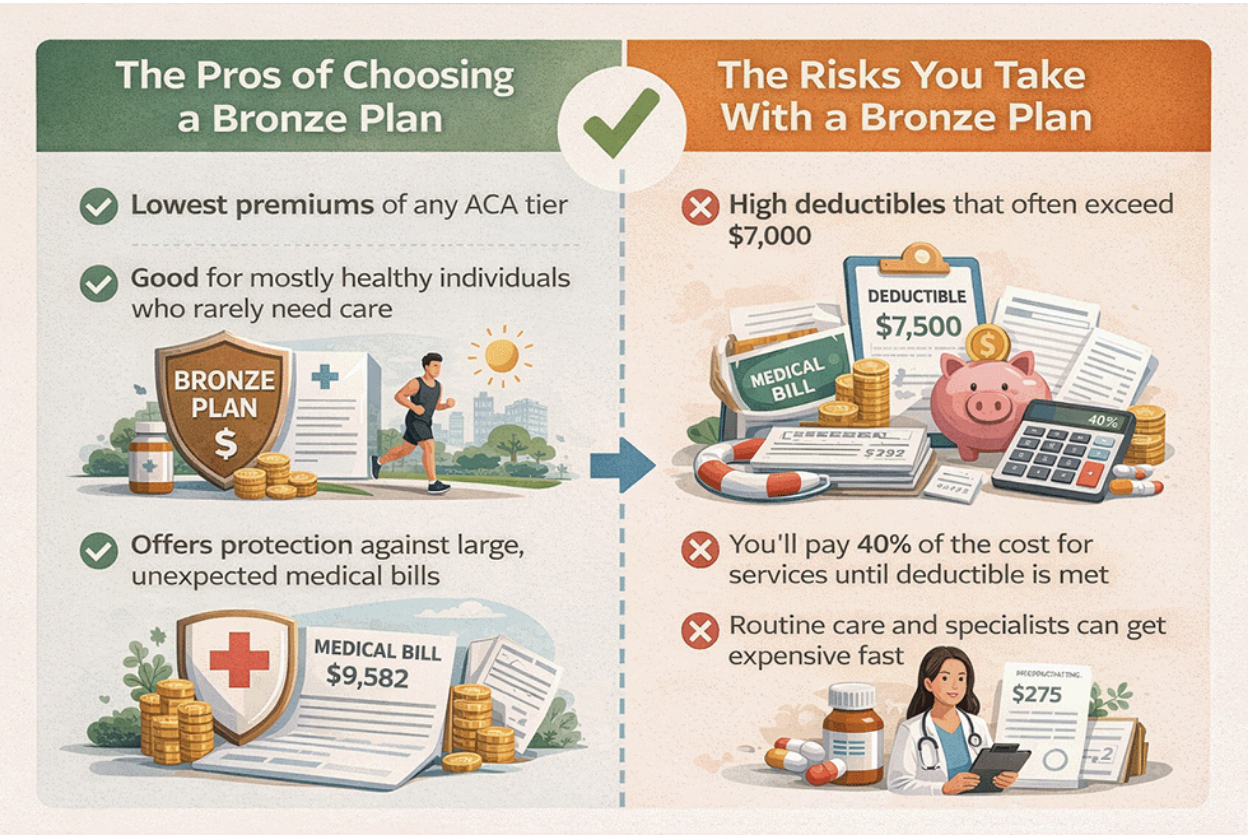

The Pros of Choosing a Bronze Plan

For the right person, Bronze plans offer some advantages:

- Lowest premiums of any tier on the Health Insurance Marketplace

- Designed for people who are mostly healthy and don’t need frequent care

- Offers protection against large, unexpected medical bills

If you live near University Hospital in Tamarac, or Cleveland Clinic Tradition Hospital in Port St. Lucie, and only want emergency coverage, a Bronze plan might work. It’s a safety net, not a full-service option.

The Risks You Take With a Bronze Plan

The lower monthly cost comes with trade-offs:

- High deductibles that often exceed $7,000

- You’ll pay around 40% of the cost for services until you hit the deductible

- Routine care, prescriptions, and specialist visits can get expensive fast

“We’ve had families in Vero Beach near Indian River Medical Center shocked by how much they paid out-of-pocket for common care,” says Stacy. “If your child plays sports or you visit doctors regularly, a Bronze plan may not save you money at all.”

Silver Might Actually Save You More

Thanks to income-based subsidies, Silver plans often qualify for Cost-Sharing Reductions (CSRs), which can drastically lower out-of-pocket expenses. You won’t get that with a Bronze plan.

If you qualify, a Silver plan may end up costing you the same or less over the year, even with a higher monthly premium. This is especially true for residents near JFK Medical Center in Greenacres or Sebastian River Medical Center in Micco, where regular care or prescriptions are part of your routine.

How to Choose the Right Plan for You and Your Family

To make the best decision, you need to consider your total health needs, not just what you pay monthly. Ask yourself:

- Do I need regular prescriptions or doctor visits?

- Can I afford to pay $7,000 or more before coverage kicks in?

- Would a higher premium save me money in the long run?

“Don’t just pick the cheapest plan. Look at your total costs for the year,” Stacy Murphy advises. “We help people do that math every day from our offices in Vero Beach, Tamarac, and even along Glades Road in Deerfield Beach.”

How Our Health Insurance Agency Can Help

We’ve been helping families and individuals across Florida for two decades. Our agents live and work in your community, from Gatlin Boulevard in Port St. Lucie to 20th Street in Vero Beach. We understand the medical providers in your area and how each plan applies to local hospitals and doctors.

Our help is always free. We don’t charge for our services, and we don’t push you toward one plan or provider. We work with private insurers and supplemental carriers to help you find the most affordable and appropriate plan for your situation.

“When people come to us, they’re overwhelmed. After a quick call, they leave confident,” says Stacy Murphy.

Is a Bronze Plan Right for You in 2026?

Bronze Tier Plans offer the lowest premiums, but also the highest risk if you need regular care. If you’re healthy and want basic protection, they might work for you. But if you expect to use your health insurance regularly, you may find yourself paying far more than expected.

The best way to find out is to talk to someone who knows the details. Let us help you compare total yearly costs, subsidy eligibility, and what’s available in your city. We’ll help you pick the right plan – without any cost to you.

Click here or give our team a call for a free, no-obligation quote. We even make house calls!

- Tamarac: (954) 642-2101

- Deerfield Beach: (754) 778-8700

- Greenacres & Vero Beach: (561) 420-0280

- Port St. Lucie: (772) 828-2840

- Sebastian (Micco): (772) 321-0813